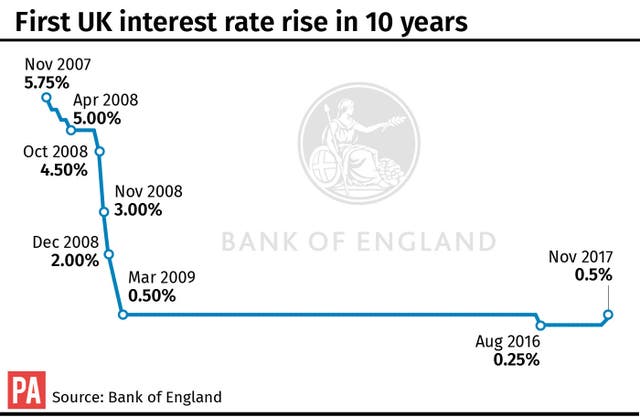

Interest rates have been hiked for the first time in more than 10 years and the Bank of England signalled more “gradual” increases are on the way to cool surging inflation.

The Bank’s nine-strong Monetary Policy Committee (MPC) voted 7-2 to raise rates from 0.25% to 0.5%, which marks the first increase since July 2007.

The quarter-point rise reverses the emergency cut seen in the aftermath of the Brexit vote shock in 2016 as the Bank sought to head off turmoil in the economy.

(PA graphic)

(PA graphic)

Millions of borrowers on variable rate deals will be impacted by the rates decision, which will add around £15 a month to the cost of the average mortgage, while it will offer some relief to savers hit by surging inflation and negligible returns.

Bank governor Mark Carney said: “With unemployment at a 42-year low, inflation running above target and growth just above its new, lower speed limit, the time has come to ease our foot off the accelerator.”

The move comes as the Bank looks to dampen Brexit-fuelled inflation, which it predicts will now peak at around 3.2% this autumn.

The Bank’s quarterly inflation report is based on financial market expectations for two more rate hikes over the next three years to return inflation back to its 2% target, which could see rates hit 1% by the end of 2020.

But sterling fell sharply, down more than 1% to 1.31 US dollars and 1.12 euros, as the Bank’s comments over future rises were more cautious than expected.

The milestone rate hike comes as the Bank cut its forecast for growth to 1.6% for 2017 from the 1.7% previously predicted, but held forecasts at 1.6% for 2018 and 1.7% for 2019.

It is pencilling in growth of 1.7% for 2020.

Nearly four million households face higher mortgage interest payments following the hike, although Mr Carney stressed the impact would be modest and gradual, with around 60% of borrowers on fixed rate deals.

He said: “Households are generally well positioned for a rate increase.

“More are in work than ever before. Only about one fifth of people with mortgages have never experienced an increase in bank rate.”

Mark Carney at the #InflationReport press conference. Watch live: https://t.co/ofjROBZ0GV pic.twitter.com/xuHJLEdMWJ

— Bank of England (@bankofengland) November 2, 2017

Mr Carney added that monetary policy would continue to provide “significant support” to the economy.

On the rates decision, Chancellor Philip Hammond tweeted: “Our economy is strong and resilient, supported by independent monetary policy and stable prices from the Bank of England.”

Experts estimate that eight million Britons have never seen interest rates rise in their adult lives, with borrowing costs having languished at rock-bottom lows since the financial crisis.

There are fears over the timing of the cut, given the uncertainty amid Brexit negotiations and as Britons are being squeezed by paltry wage growth and sharply rising inflation.

Mr Carney said the Bank had to act now to calm inflation.

“It isn’t so much where inflation is now, but where it’s going that concerns us,” he said.

Mr Carney also sought to assure the “worst” of the income squeeze was ending with wage growth set to pick up.

But for the two MPC members who voted to hold rates at 0.25% – Sir Jon Cunliffe and Sir Dave Ramsden – there were fears over muted wage growth and doubts over the Bank’s forecast for domestic inflation pressures to pick up.

The Bank also warned over “considerable risks” to the outlook amid Brexit uncertainty, while its own forecasts are based on a smooth transition period to the UK’s withdrawal from the EU.

It said the Brexit vote was already having a “noticeable impact” on the economy, but that growth was being supported by “resilient” consumer confidence, a robust global economy and its emergency rate cut from last August.

Ian Kernohan, an economist at Royal London Asset Management, said further rate hikes will depend on Brexit.

He added: “With inflation set to fall next year as the impact of sterling devaluation wanes, the MPC will stop hiking if there are clear signs that the economy is slowing.”

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here